Oops

The “certainty merchants” are starting to be found out. In this part of the world Deloitte has recently been snapped using some shoddy AI generated material in a government report. They will refund ‘some’ of the $440k fee.

Other BIG 4 consulting companies will be breathing a sigh of relief that someone else was the first to be found out. “There But for the Grace of God, Go I”. I have seen some business cases and consulting reports lately and I guarantee you; they are all utilising some shoddy AI practices.

The simplest way to fix this is the AI sandwich.

Humans are contributing most of the Intelligence. If you don’t believe me, just ask vibe coders what they do all day.

The problem for the BIG 4 is they have fired many humans and are hell bent on using AI to increase margins. This has the immediate problem of a higher risk of shoddy work and a more existential problem of being made redundant by the very technology you are selling to your clients.

As the owner of a small consultancy, I’m loving it!

AI – Embrace Small Successes to Avoid BIG Failures

There are loads of articles ATM about how big AI implementations are failing and that big companies are becoming AI sceptics. Yet, I see many AI implementations and ideas that are useful and are starting to challenge traditional thinking. Why is small AI often useful, while big AI often ends in tears?

There is a growing backlash in respect to overpromising what AI can do. One of our clients – a global financial services company, has been told to “save 20% in operating costs” using AI. One of their senior managers reported:

“Our best people are now doing all the things they hate – outsourcing creative coding to AI and then spending all day fixing s**t code”.

Kill innovation by making old ideas more efficient.

In any technology shift the first implementations usually attempt to make existing processes and procedures faster and cheaper. In the early days of the dot com era, companies were scrambling to get online, they focused on shifting their printed material onto their newly established websites. Websites were basically sales catalogues. This created demand for websites where you could compare prices, deals and offerings from multiple vendors. An early success in aggregation was moneysupermarket.com launched in 1999. The founder, Simon Nixon saw that the internet created the opportunity for real time mortgage comparison. They charged a commission for every financial product that was sold. 30p for an insurance policy and up to 30 pounds for a mortgage. As the users grew so did revenue. In 2007 he sold his share in the company for 162 million British pounds.

Early adopters of AI have fallen into the same trap. Making an existing process more efficient will make innovation difficult. Attention will be focused on the past process and the current desire to achieve the savings promised by the certainty merchants. The same technology will inevitably create space for new, innovative ideas. In the example above, it wasn’t the brokers, banks or insurance companies that built the new service. It was a small, adaptive company that wasn’t encumbered by the past.

The bigger they are the harder they fall

This phrase was a common one in rugby. It is meant as encouragement for smaller players who are faced with tackling big forwards. I weighed 78kg last time I played.

It is also true of AI implementation. The certainty merchants like to make big promises and expect big clients to pay big fees for big projects. AI transformation means going big.

None of us can predict how AI will impact our business. Going big relies on a confident prediction about future value. Where is this confidence coming from? An untested business case? An unverified case study? Many early assumptions about the value of AI are being tested and found wanting. This doesn’t mean AI is bad or broken, it means that the advice is bad, and the business case is broken.

BIG AI – A narrow view of value creation.

We start with big objectives (such as saving 20% in operating costs). The certainty merchants then build a business case based on questionable assumptions and /or case studies. The organisation aligns on the business case and implements the plan.

Feedback is limited to official reports and statistics. No one wants to flag that the transformation isn’t working because the investment is huge and failure is not tolerated. The organisation scrambles behind the scenes to mitigate the unintended consequences of the AI transformation, but this is hidden from senior management. Unfortunately, many of the people who can fix the system have been let go.

At some stage it becomes apparent that it isn’t working but the case study has already been written. The certainty merchants move on, people get fired, the smart ones left 3 months ago.

What to do?

Ditch the recently self-appointed AI experts. They do not understand your context. Experts (real or imagined) have no place in uncertain or complex situations.

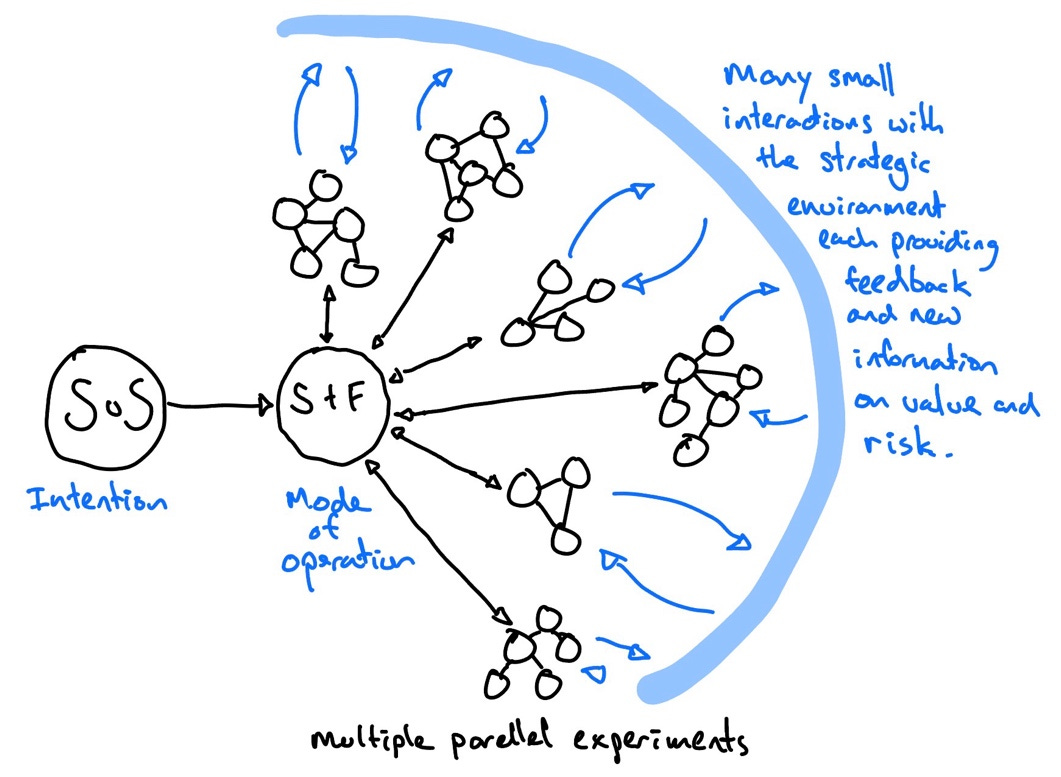

Adopt a mode of operation that allows your organisation to experiment and explore. We use the ICE Innovation® framework to stimulate creativity (in large organisations) and our Safe-to-Fail process to activate quickly and effectively. Rather than aligning on a narrow objective, activity is coherent with the shared understanding of success. Implementation is cost effective and rapid. Fast feedback allows winners to emerge as a consequence of interaction. Learning is inherent. Failures are small and provide loads of information about the utility of AI in your organisation.

Experiments are aligned with your context because they have been designed by your staff. Employee engagement is inherent in the process.

Small AI – A broad exploration to discover new value

These processes are central to adaptive strategy and activation creates meaningful exploration and amplification of the positive uses of AI. The business case becomes a matter of allocating a small amount of resource to projects that align with the intent and are safe-to-fail.

Some will fail, and we can learn. Some will succeed and we can scale. The certainty merchants have no place here.

Big vs Small

Big AI relies on a clear view of the future. You cannot reliably predict the return on a large investment unless you have clarity of the expected value. Unfortunately, technology adoption is non-linear. Small changes can have big consequences – we can imagine what these might be, but we can’t predict the scale or unintended consequences. In the past, when change was slow, experts had time to build up knowledge and experience – today, we need a process to take managed risks and adapt on the fly.

Will it reinforce the current model? – EV’s reinforce the need for roading infrastructure by making cars more efficient. The incumbents focus on platform innovation and efficiency and let the market come to them.

Will it disrupt the current model? – e-commerce has disrupted retail. Uber disrupted taxis. Air BnB disrupted hotels. The incumbents can shift if they are adaptive – i.e. The New York Times.

Will it threaten the whole industry? – Video rentals, bookstores, travel agents, printers, broadcast television. BIG 4 Advisory? The incumbents are surrounded and then destroyed by the new technology.

Using BIG AI to try and reinforce a current market position is dangerous – it could disrupt or even kill your market. Smaller more adaptive competitors are waiting. They have nothing to lose.

Small AI provides the mechanism to explore and learn. You will have many small failures but none of them will be existential. Let the new business emerge by engaging on a broad front and leaning into the things that are adding value.

Maybe just get in touch – [email protected]